On-chain analysis websites need to know

Discover the power of on-chain analysis and learn about the top on-chain analysis tools. With these tools, you can gain valuable insights from blockchain data to make informed crypto investment decisions.

Unlike traditional banking infrastructure, blockchain-based digital ledgers are publicly visible and easily audited. This transparency provides a goldmine of information, enabling practically anybody to derive insights into transaction patterns, whales movement and underlying trends.

The importance of on-chain analysis.

Since blockchains are immutable, all transactions stored and validated on the blockchain cannot be changed or removed. Immutability, security, and transparency are some features of on-chain data.

Transaction details, such as sending and receiving addresses, transferred funds, wallet addresses, transaction fees, and circulating funds for a certain address, are all on-chain data.

By compiling the indicators, technical analysis, and fundamental analysis, on-chain analysis equips traders with a holistic view of crypto dynamics. This comprehensive perspective enables them to make more data-driven decisions and adapt to the ever-changing crypto market with greater confidence and precision.

Dozens of platforms now extract, analyze and visualize on-chain data for easy use, ensuring users are more informed than ever before and can trade on an equal playing field with data-savvy funds

Introduce the On-chain analytics tools for informed crypto investing

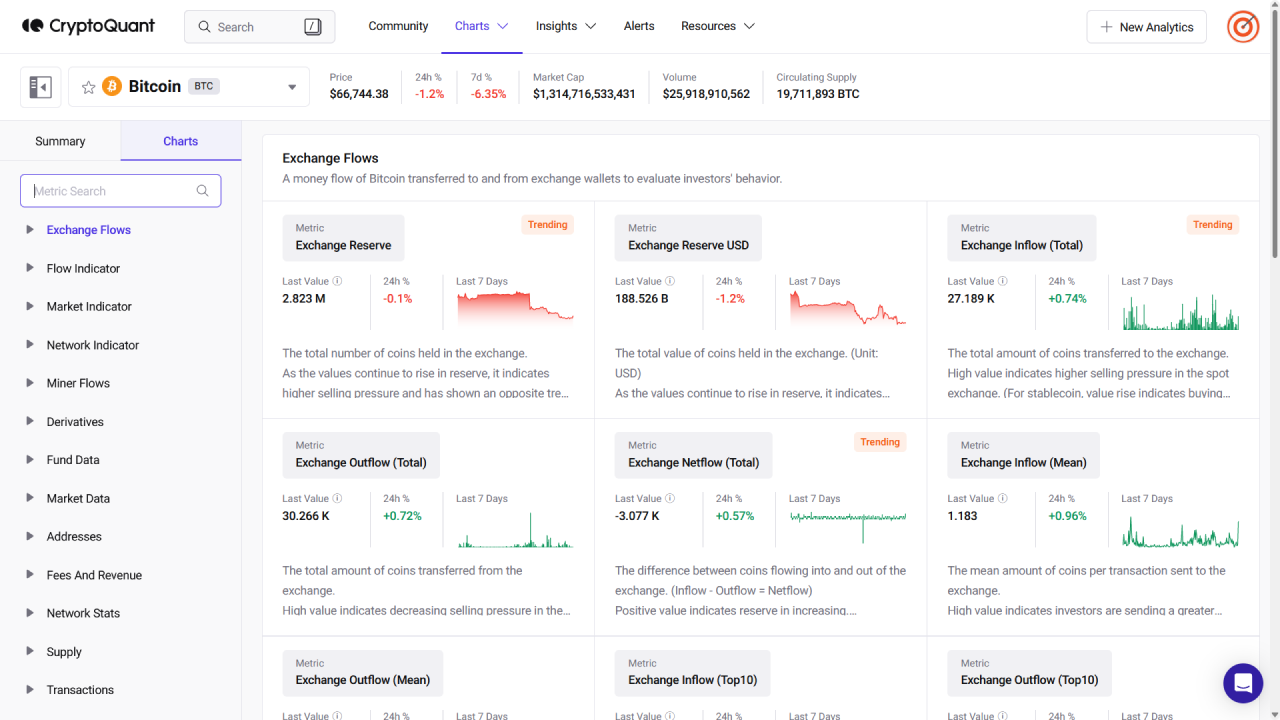

1. Cryptoquant

CryptoQuant is a versatile on-chain analytics tool that delivers market and on-chain data via API or other data analytics platforms. In the realm of on-chain analysis tools for 2023, CryptoQuant is a go-to source for comprehensive insights into popular cryptos such as Bitcoin, Ethereum, Stablecoins, and ERC20 tokens.

Key features:

- Overview charts for quick insights

- Exchange overflow data

- Pro chart for advanced analysis

- Alert notifications to stay informed

Users can select from various metrics like the Flow Indicator, Miner Flow, and more, enabling detailed examination of on-chain data. CryptoQuant also keeps one vigilant against potential scams, ensuring a secure trading experience. For traders and investors seeking reliable on-chain insights, CryptoQuant is a valuable resource in 2023.

cryptoquant.com

On-chain data is a meaningful metric that summarizes on-chain activities via transactions recorded on blockchain networks. With on-chain data, traders can see what happens in the networks that finally results in price movement. For example, network data provides us valuation sources for the networks, and flow data gives us an insight into actual major players' money flow in the networks. CryptoQuant aims to provide full historical on-chain data which allows you to build an in-depth understanding of the markets, therefore, leading you to make robust trading strategies.

2. Santiment

Santiment is a comprehensive market analytics tool that elevates your trading journey with accurate data feeds, low-latency signals, custom market watches, alerts, and flexible chart layouts. This platform is celebrated for delivering its users newsletters, reviews, and market reports. It offers a suite of on-chain analysis tools, including Sandbase, enabling users to access and analyze charts for a wide range of cryptos.

Key Features:

- Harness on-chain, social, and development metrics for informed decisions.

- Identify emerging social trends within the crypto space.

- Configure customized alerts to detect potential malicious activities swiftly.

- Stay attuned to social crypto trends shaping the market.

- Create personalized watchlists for weekly coin updates.

- Gain insights and behavioral reports from Santiment’s team of crypto analysts.

In the landscape of on-chain analysis tools, Santiment stands as a valuable asset for traders and investors in 2023.

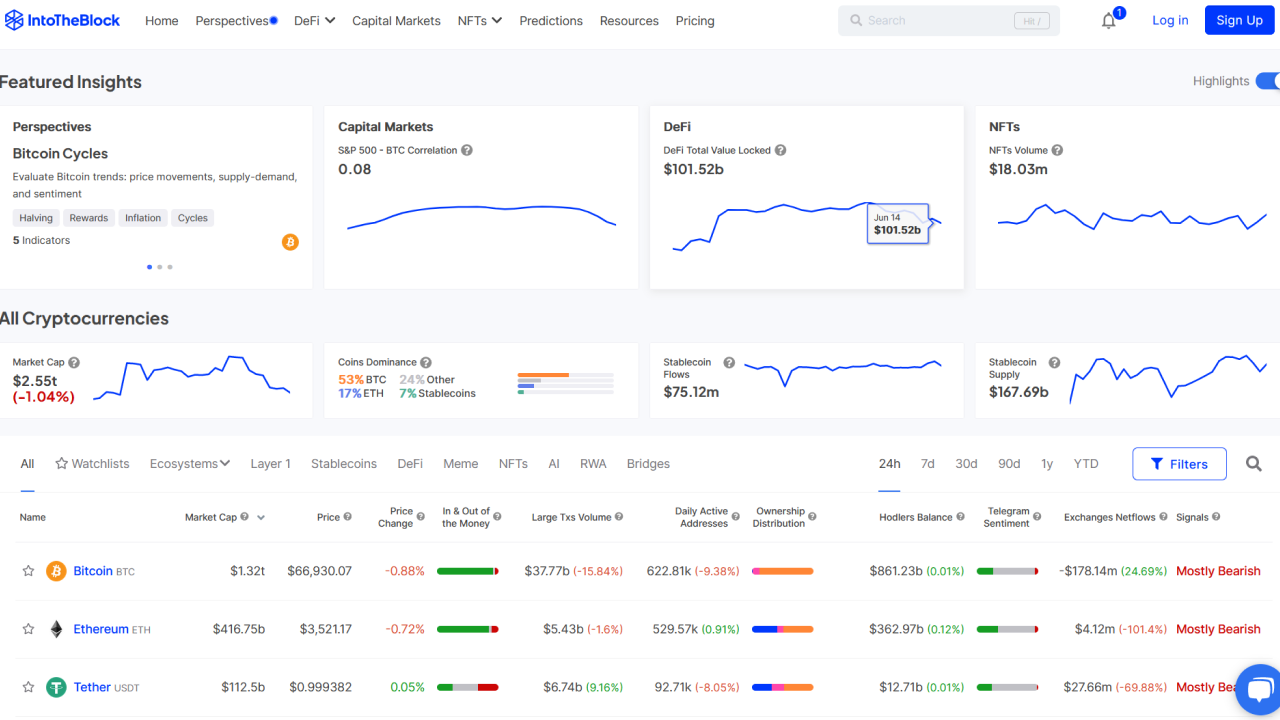

3. IntoTheBlock

More than just an on-chain analytics platform, IntoTeBlock is a premier data science tech company that uses cutting-edge AI research to provide useful intelligence for the cryptocurrency industry. IntoTheBlock makes on-chain analysis simple for both the novice and expert trader. On top of this, all features are available at a very reasonable price.

Key Features:

- Blockchain Analytics

- Price Predictions

- DeFi Analytics

- Markets

- Off-chain Analytics

intotheblock.com

Jesus Rodriguez founded the Miami-based tech company in 2018. It is a group of data scientists, cryptocurrency experts, and AI enthusiasts who have set out on a journey to unravel the mysteries of crypto assets and provide investors with relevant market intelligence. They had too many unanswered questions about cryptocurrency markets. As a result, they created a platform that allows us to use machine learning to generate new insights about this fascinating asset class.

4. Glassnode

Glassnode is an on-chain analysis tool that provides crypto market insights via on-chain indicators. Founded in 2018, Glassnode focuses on helping the research journey of crypto traders with market intelligence and other relevant on-chain data to improve users’ crypto trading decisions.

Widely known for its in-depth reports of market indicators for several cryptocurrencies, Glassnode has offered several applications that offer new ways of staying up to date with market fluctuations. The platform’s live data opens you into several charts and dashboards with detailed insights on address activity, balances, growth, supply, hodlers, etc.

Key features:

- Many on-chain market indicators for several cryptocurrencies

- More than 200 metrics

- Customizable dashboards that allow you to add your favorite metrics for certain coins

- More than 10+ years of data

- Weighing different metrics for different coins

- TradingView integration

- Comprehensive resources on famous blockchains and cryptocurrency

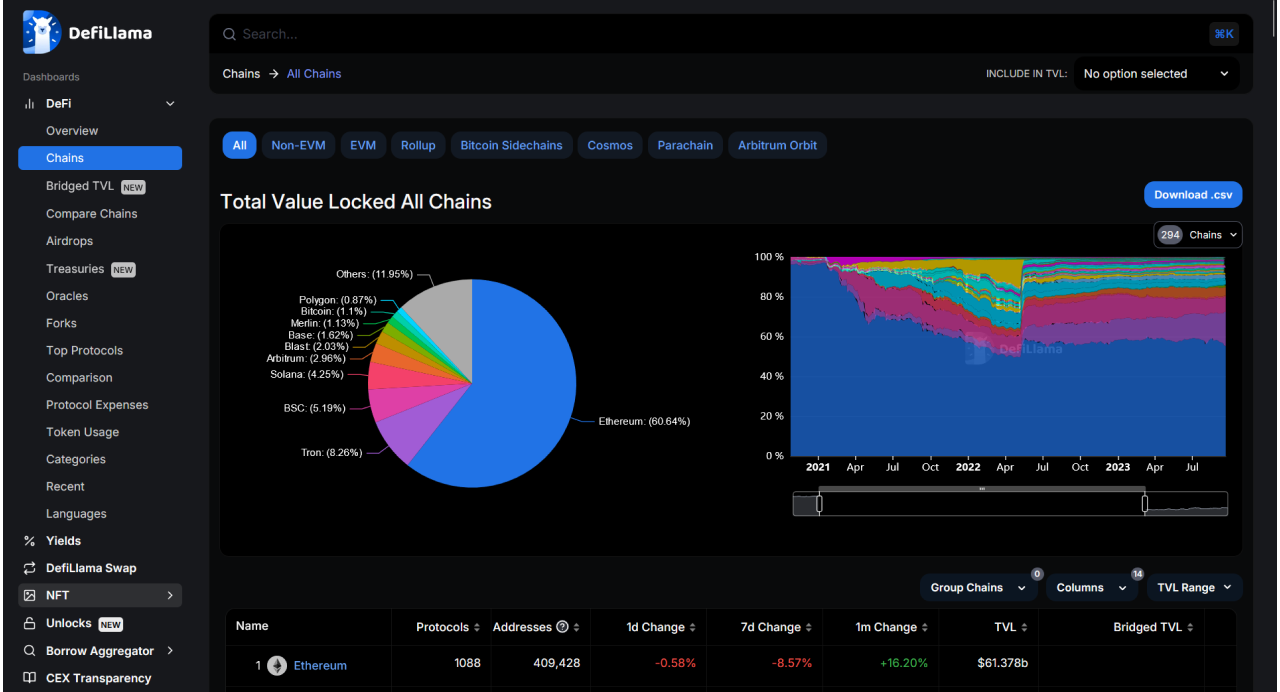

5. Defillama

DefiLlama is part of Llama Corp, a collective building out blockchain data analytics, infrastructure, payments, cross-chain, and media solutions, with over 10 million monthly users.

The platform takes its name from monitoring the “llamas” (DeFi projects) within the vast DeFi landscape.

DeFi Llama, or DeFiLlama, is a leading blockchain data analytics platform that focuses on the DeFi ecosystem. It aggregates data from multiple sources and offers a wide range of tools to perform in-depth fundamental analysis of the wider DeFi sector and individual decentralized applications (dapps).

DeFiLlama is the go-to platform to track the total value locked (TVL) on DeFi projects – the most important metric in the DeFi sector. It also offers many other metrics such as market cap and token prices, which are powered by CoinGecko APIs.

DefiLlama’s analytics dashboards aggregate data to display updated information about the TVL, revenue, fees, and volumes of all known DeFi protocols on Layer 1 and Layer 2 blockchains

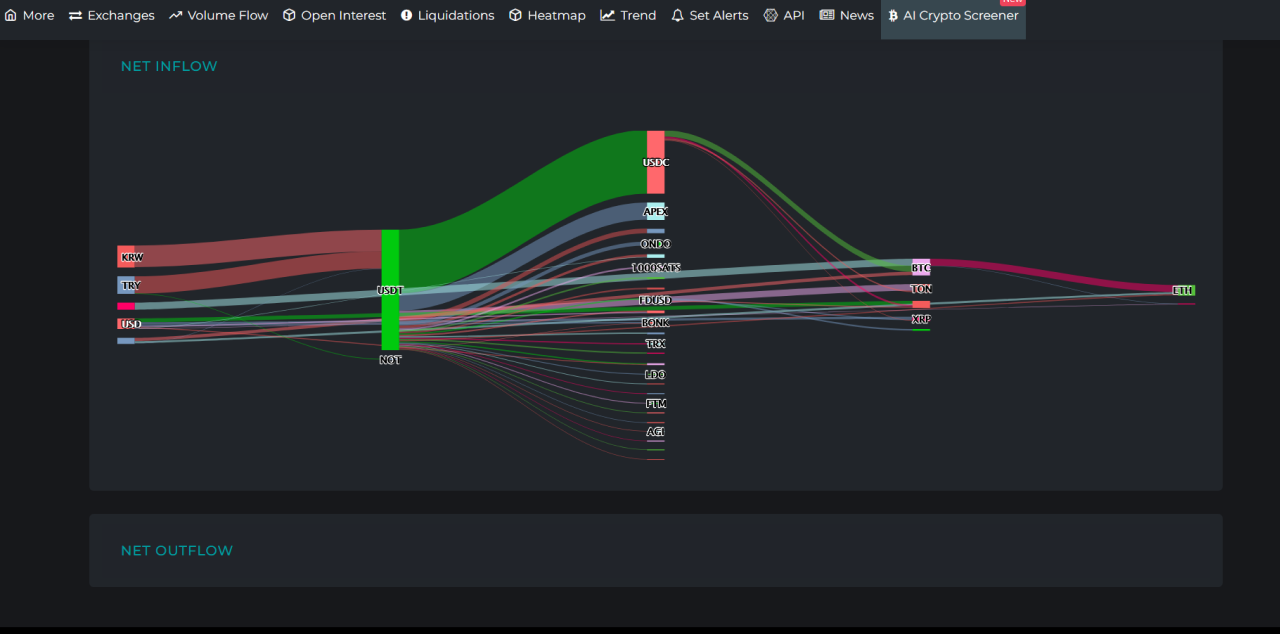

6. Cryptometer

Money Flow Tracker provides a clear visualization of liquidity transitions between assets, enabling you to see how funds are moving from one cryptocurrency to another. This insight helps you understand market dynamics and identify potential opportunities.

7. DappRadar

DappRadar is a Web3 tool that offers real-time insights and analytics into decentralized apps. This enables users to explore and navigate through data from various blockchain networks.

Think of DappRadar as a Web3 Appstore similar to Google Playstore but focusing on decentralized applications built on blockchain networks. Just as you would visit app stores to discover, download, and interact with mobile applications, DappRadar is a directory to explore, monitor, and analyze various DApps across blockchain networks.

In both cases, users seek applications based on their interests and needs, and the platform provides insights, reviews, and performance data to aid users in making informed choices. However, DappRadar specifically caters to decentralized and blockchain-driven applications such as DeFi and GameFi protocols and NFTs.

Decentralized applications (DApps) are built for many reasons, such as to improve user experience, promote security, engage with communities, conduct market research, and tap into financial opportunities, making it essential that users can track and navigate them. Although most DApps are built on the Ethereum network, DappRadar makes it easier to navigate through DApps built on other networks like Avalanche, BNB Chain, and Solana.