Dow Theory in the stock market

What is Dow theory? History about Charles Henry Dow, Importance of Dow Theory and how to use Dow theory in the stock market.

What is Dow Theory?

The Dow Theory is a fundamental principle of technical analysis that is widely used to identify the overall trend of the stock market. It was developed by Charles H. Dow in the late 19th century.

The Dow theory was developed to explain the concept that share market moves in trends that can be analyzed and predicted. Dow Jones theory provides a framework for understanding market behavior and making informed investment decisions.

Traders and investors have widely used Dow Theory since then to identify market trends and base investment decisions on them. In this blog, we will take an overview about Dow history, how it works, its pros and cons, and the key principles and trading strategies associated with it.

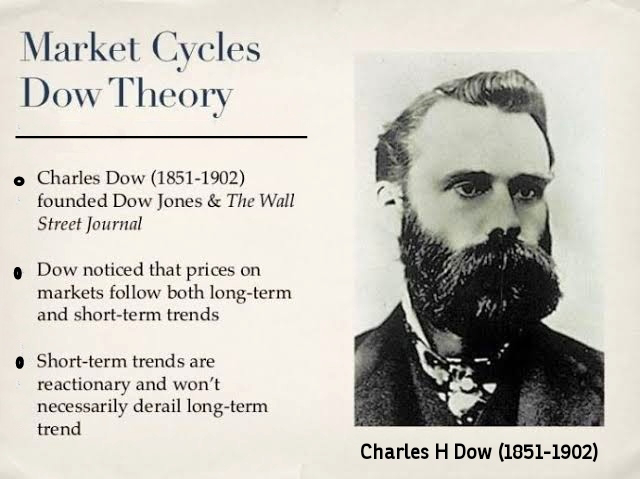

A little about Dow' history.

Charles Henry Dow (was born in Sterling, Connecticut, on November 6, 1851 – Dead December 4, 1902) was an American journalist who co-founded Dow Jones & Company with Edward Jones and Charles Bergstresser.

Dow also co-founded The Wall Street Journal, which has become one of the most respected financial publications in the world. He also invented the Dow Jones Industrial Average as part of his research into market movements. He developed a series of principles for understanding and analyzing market behavior which later became known as Dow theory, the groundwork for technical analysis.

Charles Henry Dow

Charles Henry Dow

How does the Dow theory work?

Dow theory meaning is based on the idea that the stock market theory moves in three trends: the primary trend, the secondary trend, and the minor trend. The primary trend is the overall direction of the market, which can last for several years. The secondary trend is a correction to the primary trend, which can last for several months. The minor trend is a short-term fluctuation in the market, which can last for several days.

This theory also emphasizes the importance of volume in confirming price movements. If one of the prices are rising in high volume, it is considered to be a bullish sign. On the other hand, if prices are falling on high volume, it is considered to be a bearish sign. Dow’s Theory also emphasizes the importance of trend confirmation. For example, if the Dow Jones Industrial Average and the Dow Jones Transportation Average are both moving in the same direction. It is considered to be a confirmation of the current trend.

Key Principles of Dow Theory

1. The Market Discounts Everything

The first principle of Charles Dow’s Theory is that the market discounts everything. This means that all the information about a company or an industry is already reflected in the stock price. Investors can analyze past market data to try to predict future market trends. But ultimately, the market will always reflect all available information.

2. The market has Three Trends

The second principle of Dow’s Theory is that the market has three trends. These are the primary trend, the secondary trend, and the minor trend. The primary trend is the long-term direction of the market and can last for several years. The secondary trend is a counter-trend movement that lasts several weeks or months, and the minor trend is the day-to-day fluctuations of the market.

3. Primary Trends Have 3 Phases

According to the Dow Theory, the primary bull and bear trends pass through three phases.

A bull market's phases are the:

Accumulation phase: Prices rise alongside an increase in volume.

Public participation (or big move) phase: Retail and average investors begin to notice the upward trend and join in—generally, this is the longest phase.

Excess phase: The market reaches a point where experienced investors and traders begin exiting their positions while the larger average investing population continues to add to their positions.

A bear market's phases are the:

Distribution phase, where news of a decline begins to be distributed throughout the investing community via various channels.

Public participation phase: Opposes that of a bull market participation phase—average and retail investors are selling stocks and exciting positions to reduce losses. Again, this is generally the longest phase.

Panic (or despair) phase: Investors have lost all hopes of a correction or full reversal and continue selling at scale.

4. Trend Confirmation

The third principle of Dow’s Theory is trend confirmation. This means that a trend is not considered to be valid until it is confirmed by both the Dow Jones Industrial Average and the Dow Jones Transportation Average. According to this theory, if both the Dow indexes are moving in the same direction, it confirms the trend. If they are moving in opposite directions, it indicates a potential reversal in the trend.

5. Volume Confirmation

The fourth principle of Dow’s Theory is volume confirmation. This means that a trend is more likely to be sustained if there is a high volume of trading activity in the direction of the trend. Low volume during a trend may indicate that the trend is weak and may not be sustained.

6. Double Bottom and Top Formation

Like in candlesticks, there are few important patterns in Dow Theory as well, one of the dow process patterns is double bottom and double top formation.

A double top and double bottom are recognized as reversal patterns in Dow Jones trading. A double bottom takes place when a stock’s price reaches a modest low and promptly bounces back with a rapid recovery. Subsequent to the price rebound, the stock sustains trading at an elevated level (in relation to the initial low) for a minimum of two weeks, with well-distributed intervals. Following this period, the stock makes an attempt to return to the previously established low. If the stock successfully holds its ground, experiences another rebound, then a double bottom pattern emerges.

The formation of a double bottom is perceived as a bullish signal, indicating potential buying opportunities. Let’s have a look at the dow theory chart to understand this pattern.

Advantages of Dow

Some advantages of Dow theory are as follows:

Long-term Perspective: Dow Theory is based on long-term market trends. It can provide investors with a big-picture view of market movements. It can also help investors avoid knee-jerk reactions to short-term market fluctuations and focus on long-term growth potential.

Easy to Understand: This theory is based on simple principles. The theory provides clear guidelines on how to identify market trends, and it can be a useful tool for investors looking to better understand market behavior.

Follows Market Trends: The Dow process is based on the idea that the market is always right. And it helps investors follow the current trend. By identifying the trend, investors can make better decisions about when to buy and sell securities.

Cons of Dow Theory

Some cons of Dow’s Theory are as follows:

Not always accurate

While the Dow Theory is a useful tool for analyzing market trends, it is not always accurate in predicting future market movements. There are various external factors, such as political and economic events, that can influence market behavior and make it difficult to rely solely on the Dow Theory.

Ignores other important factors

The Dow process focuses primarily on market trends and does not take into account other important factors that can affect market behavior, such as company fundamentals, macroeconomic indicators, and industry trends. Therefore, it may not provide a comprehensive picture of the market.

The Bottom Line

The Dow Theory is a technical framework that predicts the market is in an upward trend if one of its averages advances above a previous important high, accompanied or followed by a similar advance in another corresponding average.

Primary Trends Have 3 Phases, the primary bull and bear trends pass through three phases

The theory is predicated on the notion that the market discounts everything, consistent with the efficient market hypothesis.

In such a paradigm, different market indices must confirm each other in terms of price action and volume patterns until trends reverse.